The challenge

Our client is launching a new biologic in immunology across several indications and needed to understand the market, including the patient pool, treatment landscape, potential uptake and reimbursement as well the pricing opportunity. They wanted to use the insights to develop the optimal launch strategy across 12 markets and across indications, and also support the local market access teams by conducting a mock negotiation with payers.

The solution

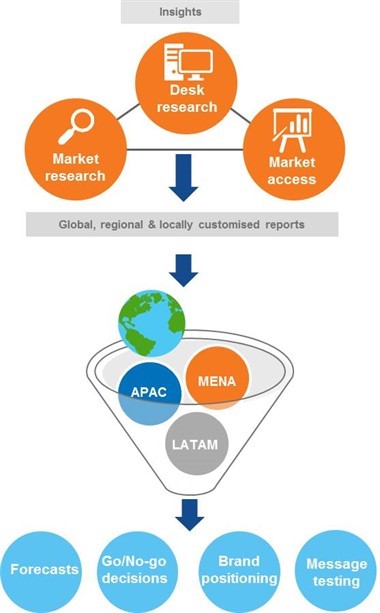

Our solution drew on our market access and market research expertise, across primary and secondary research. Quantitatively, we explored the treatment landscape and potential uptake with dermatologists across the global emerging markets of interest (covering MENA, LatAm and APAC), and followed up qualitatively with a subsample with key questions of interest.

We determined the optimal pricing strategy and implications of cross-indication launch with payers during in-depth interviews. Desk research allowed us to use secondary data sources to establish the size of the patient pool targeted for reimbursement (with some further qualitative interviews helping fill any gaps in the sources), and assess relevant analogs for the impact of reimbursement/funding decisions. A face-to-face workshop was conducted with the local and regional teams to simulate a live payer negotiation between the sponsor and payers in each country. Objections raised by the payers were further investigated and a payer objection handler was developed for the team.

We took a collaborative approach to material design and actively engaged global, regional and local teams to get their thoughts on the key information required. Consolidated all-market reports were supported by country decks, and regional and country presentations were delivered.

The outputs

The data provided has fed directly into the brand plans and market access strategy in each market. For example, the market sizing data for the current market and the potential uptake have fed into local and regional forecasts, and in some cases have contributed to go/no-go decisions for launching the leading indication first, or to delay submission. The market understanding (including potential barriers and satisfaction) has given some first thoughts on positioning and appropriate patient types, to start to guide marketing and message development. The mock negotiation allowed the sponsor to refine their value proposition and be prepared for upcoming live negotiations.