Back in June 2020, we took an in-depth look at the unprecedented challenge of pricing a coronavirus vaccine. We explored how payers’ expectations and willingness to pay would depend on the – at that time unknown – specificities of the various vaccines that would become available. We identified some interesting nuances around variation in willingness to pay based on dosing schedule and duration of protection, but there were still many question marks concerning how effective the vaccines would be, how the virus would evolve, and what alternatives there might be in terms of therapies.

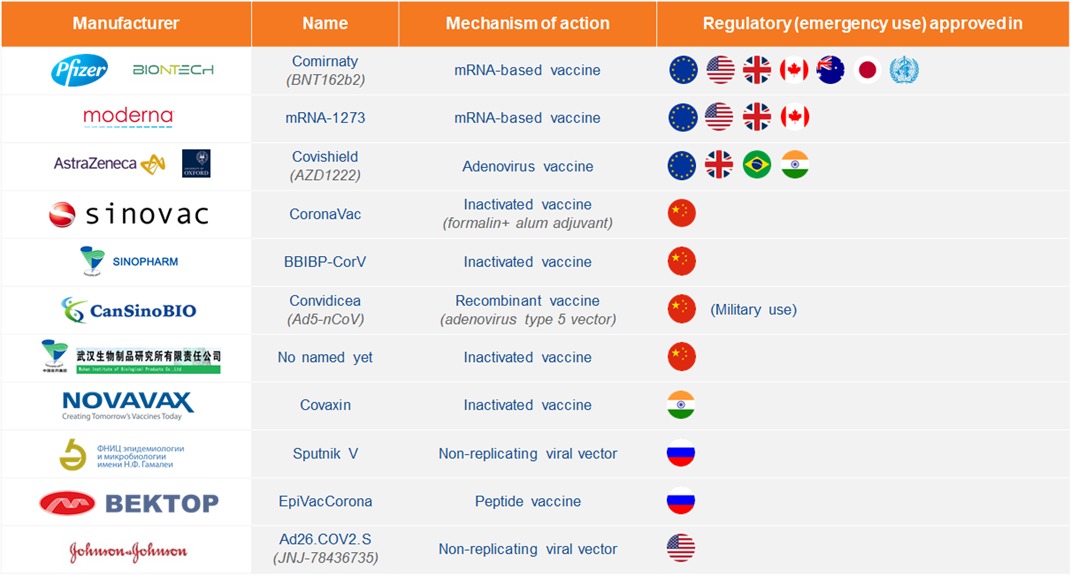

Eight months later, some (but not all) of those questions have now been answered. While progress in developing therapeutics has disappointed, the speed of vaccine development has far exceeded initial expectations, with multiple SARS-CoV-2 vaccines having demonstrated high levels of efficacy and been granted emergency use authorizations.

Source: Adapted from https://www.raps.org/news-and-articles/news-articles/2020/3/covid-19-vaccine-tracker

“In pandemic” pricing has not followed the usual market mechanisms for vaccine pricing for three key reasons:

The first is charging lower prices to countries who invested in their research and development. For example, Moderna, who’s mRNA-1273 vaccine development was subsidized by the US government, is charging the US less per dose than the EU. Meanwhile, BioNTech/Pfizer, which benefited from EU financial support in developing Comirnaty, is charging the EU less per dose than elsewhere. The second relates to how these vaccines have been procured, budgeted for and financed – through advance market commitments with supranational procurement deals, meaning pricing and reimbursement was negotiated rapidly and directly with governments, blocs and public health authorities.

Finally, the pandemic forced companies to give careful consideration to the reputational impact of setting the wrong price, with Johnson & Johnson and AstraZeneca committing not to making a profit during the pandemic (though the latter have reserved the right to make a profit once the pandemic is declared over).

So far their actions seem to be paying dividends for the industry: in a survey we commissioned in February 2021, 68% of 274 US & EU physicians said that COVID-19 (and how it has been handled) has had a positive impact on their perceptions of biopharma manufacturers. This will hopefully springboard pharma’s reputation so it’s no longer considered in the same category as gambling and tobacco industries.

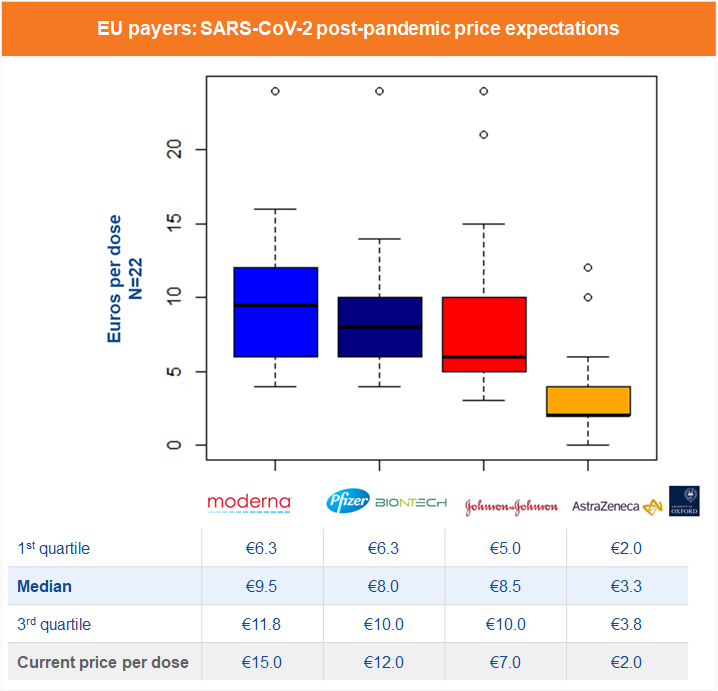

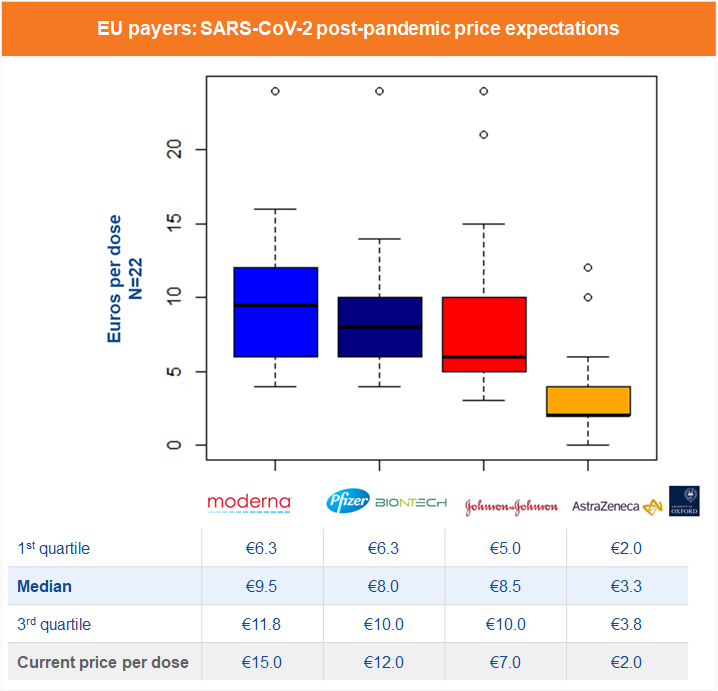

But how will vaccine prices evolve once we emerge from the current crisis, assuming they revert to following the pre-pandemic pricing and reimbursement process? We reached out to 22 payers and national immunization technical advisory group experts within our EU network to ask their thoughts on what post-pandemic prices they would consider to be acceptable for the following four most procured SARS-CoV-2 vaccines, based on current clinical results and procurement prices.

The results – presented below – are primarily in the €8-12 range, suggesting that seasonal influenza vaccines, rather than ‘one off’ vaccines such as Shingrix (herpes zoster), Prevnar (pneumococcal) or Gardasil (HPV), are considered the closest benchmark. This is potentially driven by uncertain duration of protection, or the low anchor of the current ‘in pandemic’ prices.

Some trends towards payers favoring particular vaccines starting to emerge. The Oxford/AstraZeneca vaccine, with less impressive published efficacy data, is expected to command the lowest price of the four. The BioNTech/Pfizer vaccine, the first to have received emergency use authorization in most countries, does not seem to have suffered from the initial requirement of ultra-cold freezers to store it in conditions of between minus 60C and minus 80C (which has only been relaxed to normal medical freezer temperatures of minus 15C to minus 25C in mid-February).

Surprisingly, the J&J vaccine, later to arrive to the market but with data supporting up to 84% efficacy with a single shot, which would significantly reduce the burden of the rollout of the mass vaccination programs, is only considered to command a price per dose similar to the Pfizer and Moderna mRNA vaccines, which both require two doses. Perhaps this suggests payers are not thinking about cost effectiveness in a more holistic sense, but rather see the vaccines market as a tender market in which each vaccine should ideally cost as little as possible.

The coronavirus vaccine landscape is evolving at a fast pace, and the original question we flagged relating to duration of protection remains uncertain – if the vaccine has to be given seasonally, as for influenza, the ramifications on healthcare budgets will be huge. New issues, such as the efficacy of the respective vaccines against the new strains of the virus, have arisen. And the success of vaccination efforts in bringing the virus under control, reducing transmission and achieving herd immunity remains an open question. Plus there are unresolved issues relating to manufacturing capacity and supply, and a tension between protecting national interests and diplomacy in the drive to ensure global equity of access, particularly securing sufficient doses for lower income countries.

There are other promising vaccines in the pipeline, such as CureVac’s first generation mRNA candidate which is currently in phase III trials and undergoing a rolling review with the European Medicines Agency, with their next generation multi-valent and monovalent candidates being developed in partnership with GSK not far behind. The delayed and modified Sanofi/GSK candidate is also back on track, with a new phase II study announced last month.

As we learn more and gather more data in each of these areas, expectations relating to price of COVID-19 vaccines will continue to change.