Authored by: Marc Garcia and Tania Rodrigues

Colombia, with a population of approximately 52 million that is growing at a rate of 1.1%, and healthcare expenditure accounting for about 9% of its GDP, currently ranks among the top five pharmaceutical markets in Latin America. Now, the imminent introduction of a new proposed price control methodology for patented drugs at launch could potentially affect Colombia’s pharmaceutical market attractiveness.

Currently, a manufacturer entering the Colombian market can freely set the maximum sale price of a new patented drug, which must be reported to the National Price Commission of Medicines and Medical Devices (CNPMDM) after the National Institute for Food and Drug Surveillance (INVIMA), Colombia’s regulatory body, grants marketing authorization.

The price of a new patented drug is not controlled at launch by the CNPMDM or an independent body that can holistically consider different aspects to determine its value. Following its launch, a new patented drug may be subject to direct price control by the CNPMDM through an international reference pricing (IRP) mechanism. In May 2013, the CNPMDM issued Circular 03 of 2013, which outlines regulations establishing price caps for specific drugs. According to Circular 03, in practice, IRP is used for a patented drug when its national reference price, calculated by the CNPMDM for every drug post-commercialization, is higher than its corresponding IRP price.

However, this is about to change with the value-based pricing (VBP) reform proposal, which stakeholders have been discussing since 2018. The objective of this reform is to bolster what is referred to as the ‘front door’ (puerta de entrada) to the Colombian market, achieved by introducing a pricing control mechanism for new drugs upon market entry. Although implementation has been delayed, this reform is moving forward. In July 2023, we interviewed an expert on Colombia’s health technology assessment (HTA) process, to better understand the status of this proposed reform and explore implications for manufacturers of innovative drugs.

An in-depth dive into the proposed VBP reform

The new VBP framework

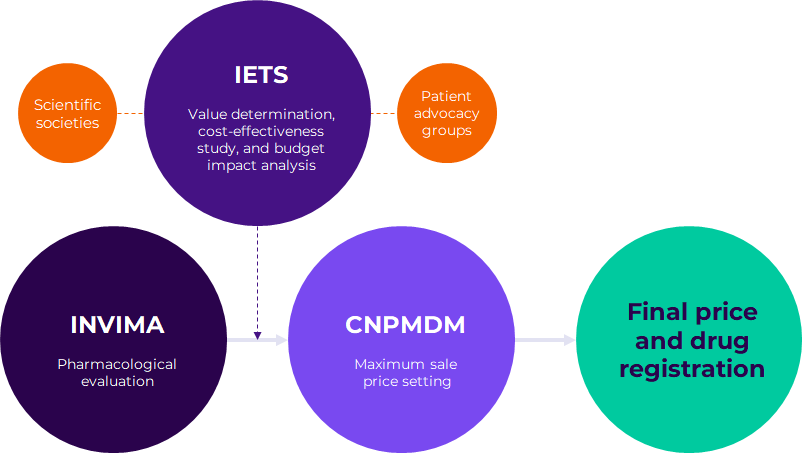

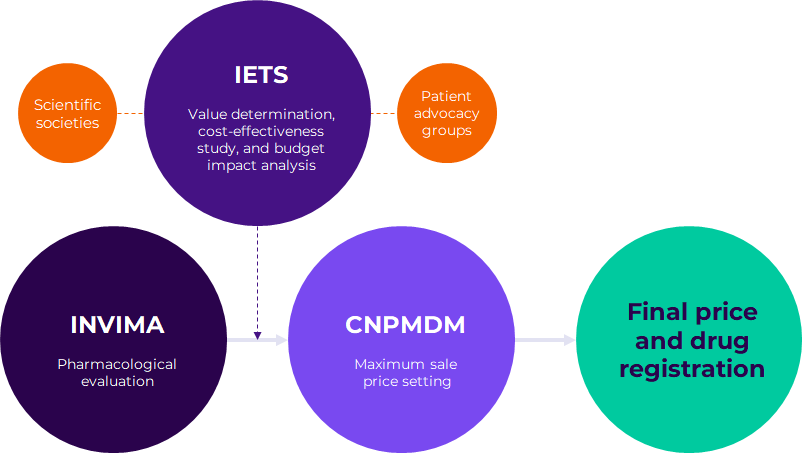

The most recent draft of the VBP framework, published in April 2023, outlines the new proposed pathway (Figure 1). As highlighted by the Colombian HTA expert we interviewed, the manufacturer must submit a registration proposal to INVIMA, including data that substantiates the value of the drug. Before INVIMA grants the registration, The Colombian agency of health technology assessment, Instituto de Evaluación Tecnológica en Salud (IETS) will determine its value in an independent manner and draw up three different documents to help the CNPMDM set the maximum sale price:

- Classification of the therapeutic value of the new drug (detailed in the following section)

- Cost-effectiveness evaluation (not applicable for orphan disease treatments)

- Budget impact analysis

Figure 1. Proposed VBP pathway for a new patented drug.

IETS determines the therapeutic value

Before the IETS official evaluation, manufacturers will be able to engage in early discussions with the HTA body. These discussions may be promoted directly by the IETS after a horizon scanning analysis or requested by the manufacturer. Starting the day after INVIMA’s communication of a new drug registration, IETS has 135 business days to carry out the evaluation, including a public consultation to engage scientific communities and the general population.

In April 2023, IETS published the ‘Manual metodológico para la definición de la categoría de valor terapéutico’ to classify a new drug based on therapeutic value. According to the Colombian HTA expert, IETS reviewed evaluations conducted by different HTA agencies internationally and worked closely with Germany’s Institute for Quality and Efficiency in Health Care (IQWiG) to set up this new methodology.

To define the therapeutic value of a new drug, the HTA expert clarified that IETS will consider two factors: 1. Certainty of the evidence, based on the Grading of Recommendations Assessment, Development and Evaluation (GRADE) methodology and 2. Magnitude of the effects, determined by safety and efficacy data.

The drug’s value will also depend on the IETS’ chosen therapeutic comparator, based on the manufacturer’s evidence coupled with a literature review (including national guidelines) as well as input from scientific societies and patient advocacy groups. Ideally, the comparator will be registered in Colombia, but indirect comparisons can be made in the absence of such a registration.

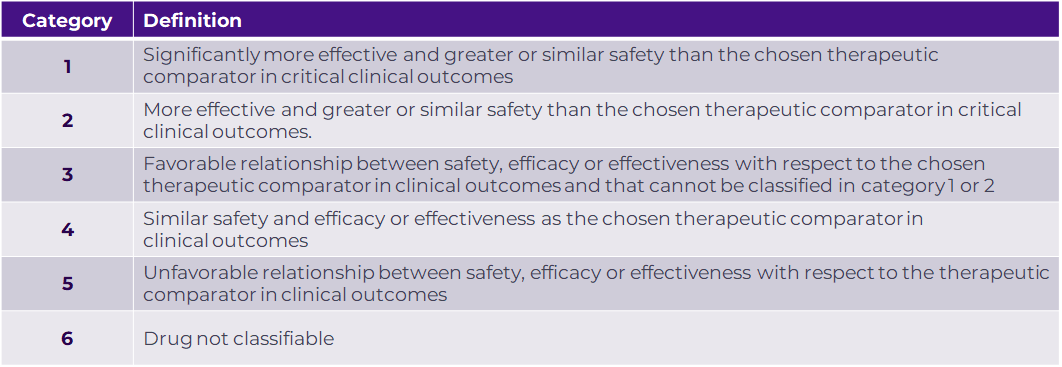

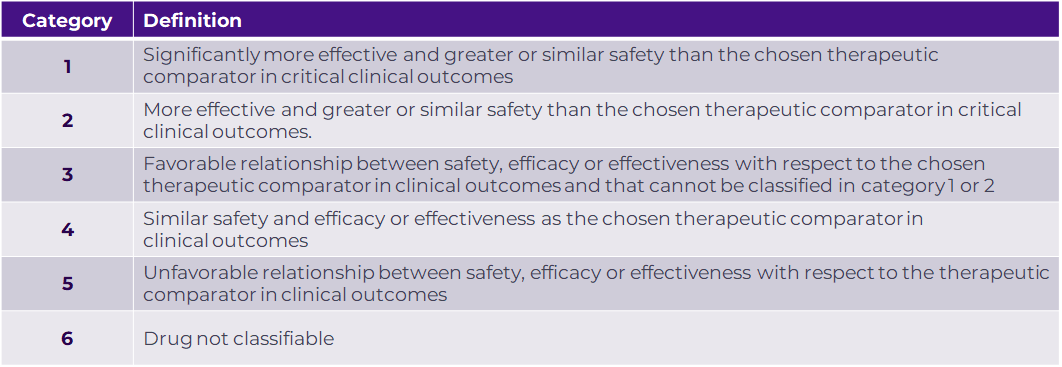

Based on the evidence and input from scientific societies and patient advocacy groups, the IETS will then classify the drug and issue it a value category, one of six available (Figure 2)2. The category attributed to the drug is linked to the subsequent CNPMDM price setting mechanism for the new drug.

Figure 2. IETS’s value added drug classification categories.

Figure 2. IETS’s value added drug classification categories.

According to the expert we interviewed, this value determination approach could be susceptible to change because it does not yet consider the therapeutic threshold value or the significance of clinical results in terms of improving patient outcomes generated by a drug in a specific indication.

CNPMDM sets the maximum sale price

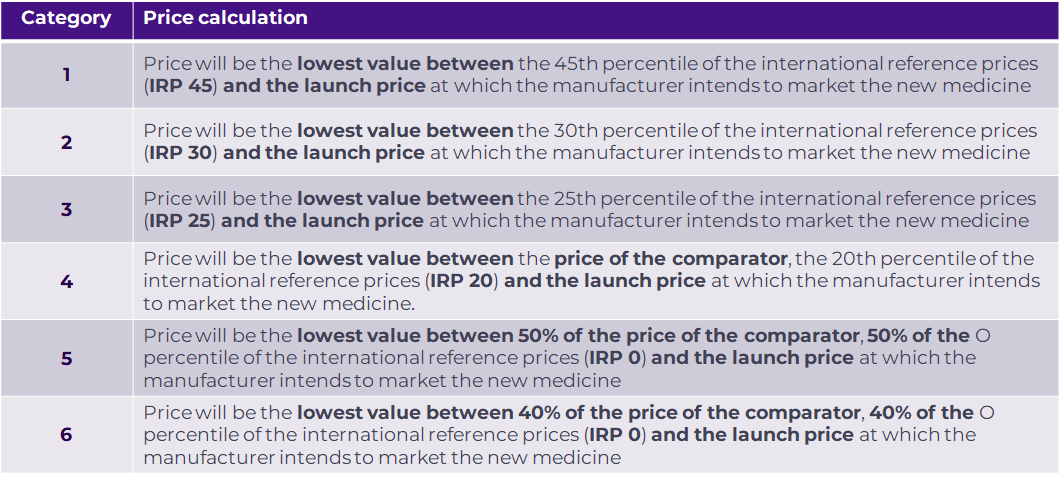

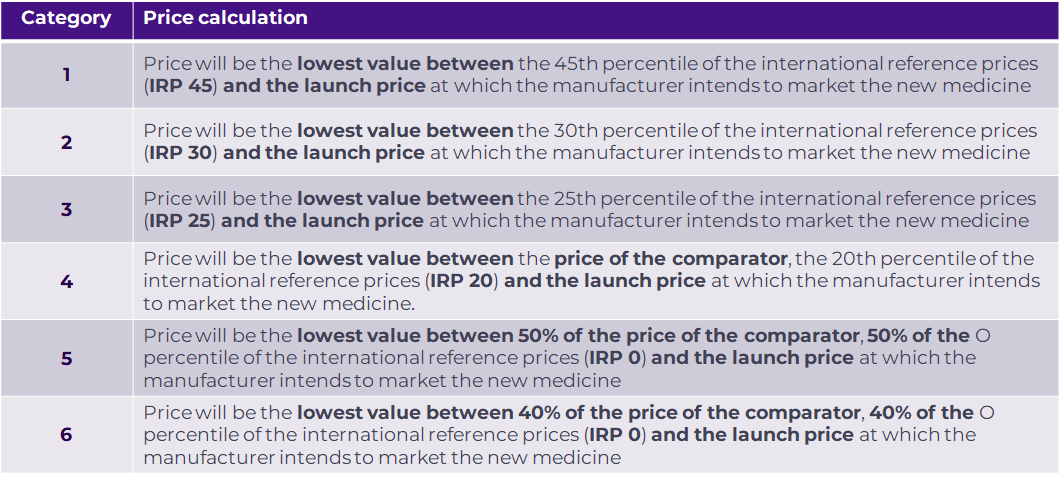

In August 2023, the CNPMDM issued Circular 16 of 2023. According to this, the CNPMDM will set the maximum sale price for a new medicine according to the IETS category of therapeutic value (Figure 3). This price will be anchored to the IRP price, with the IETS chosen comparator cost only coming into play for Categories 4,5 and 6. The price for new drugs classified in Categories 1, 2 and 3 will be valid for three years, after which CNPMDM will reassess the price.

Figure 3. CNPMDM maximum sale price calculation for a new drug based on IETS value categories.

Figure 3. CNPMDM maximum sale price calculation for a new drug based on IETS value categories.

The selection of the 16 countries as a reference basket for the IRP mechanism (see Figure 4) is based on geographic proximity, price regulation policy, belonging to the OECD, macroeconomic stability, and information availability.

Figure 4. CNPMDM basket of reference countries used in IRP mechanism.

Figure 4. CNPMDM basket of reference countries used in IRP mechanism.

To promote transparency for the new drug, the CNPMDM will publicly release the final launch price, the IRP price used, the price of the therapeutic comparator (when relevant), the therapeutic value evaluation, and the budget impact analysis.

When a drug has more than one indication with a different therapeutic value category assigned, CNPMDM will set the price based on the category with less budget impact on the healthcare system. The early interactions with IETS and its horizon scanning are meant to guide how a new drug with multiple indications should be initially evaluated.

Although the drug pricing methodology is established in the August 2023 circular, the final VBP resolution will be applicable from the year after its publication in the Colombian Official Gazette4. This would provide enough time to adapt to the different process modifications in terms of personnel and resources in the three entities involved: the IETS, the INVIMA, and the CNPMDM.

What are the implications of these changes for pharma?

Once Colombia implements this reform, it will radically change the market access and pricing landscape, with a new evaluation paradigm due to the new interactions with key stakeholders at launch. This is set against discussions as part of Health Reform Proposals in the Colombian Congress to change IETS from a mixed to a public entity, which would lose its critical autonomy as the sole body responsible for determining a new drug’s therapeutic value.

Like the VBP model adopted in Brazil almost 20 years ago, this reform seeks to reduce the launch price of patented drugs. Notably, compared to the current Colombian IRP-based price regulation, the reference basket of markets for Colombia’s proposed VBP model swapped out Germany for lower-priced markets Italy and Greece. However, manufacturers can appeal the IETS attributed category to avoid having to decide if it is worthwhile to launch at a lower achievable price.

Nevertheless, this reform is anticipated to introduce a structured and more transparent evaluation process for new drugs and indications, potentially instilling confidence in pharmaceutical companies regarding the process’s objectivity. The early interactions with the IETS and even through the horizon scanning exercise could, for example, allow manufacturers to plan in terms of the most suitable indication launch sequence.

Since the IETS evaluation considers scientific societies and patient advocacy groups, manufacturers have opportunities to leverage and influence the final VBP outcome for their new drug. This engagement is important to make for example the case for a new drug not to end up classified as Categories 4, 5 and particularly 6 whereby the price would be dampened further by the IETS chosen comparator.

In this dynamic environment, staying informed about the changes is crucial. Moving forward, manufacturers must vigilantly monitor the implementation of the reform and be prepared to adjust their launch strategies based on insights gained from the new ‘rules of the game’ and analogs undergoing VBP evaluations. This adaptation will enable them to leverage emerging opportunities for market access in Colombia.

Information was accurate as of September 1st, 2023.

Figure 2. IETS’s value added drug classification categories.

Figure 2. IETS’s value added drug classification categories. Figure 3. CNPMDM maximum sale price calculation for a new drug based on IETS value categories.

Figure 3. CNPMDM maximum sale price calculation for a new drug based on IETS value categories. Figure 4. CNPMDM basket of reference countries used in IRP mechanism.

Figure 4. CNPMDM basket of reference countries used in IRP mechanism.