A glimmer of hope for Alzheimer’s patients, but at what cost?

Published in PME Magazine

The shock early June approval of Biogen’s Aduhelm (aducanumab) for the treatment of Alzheimer’s disease by the FDA through its accelerated approval pathway has generated a great deal of debate in the US. Despite being applauded by patient advocates as the first approval in this high unmet need therapy area in 18 years, heralding the potential to offer patients new hope and attract future investment, the decision has come under fire from clinicians (and specifically the FDA’s own advisory committee!) due to the drug’s inconclusive trial data. Use of amyloid beta plaque reduction as a surrogate endpoint leaves unanswered questions about its real-world clinical benefit. And its $56,000 annual price tag has spooked payers, who will face major challenges managing the affordability for such a broad patient population, as well as concerns about what precedent this might set for future approvals, both in Alzheimer’s and in other high-need, high-prevalence diseases. The whole debacle has gone on to attract the attention of lawmakers, who last week launched an investigation into the process that led to its approval. Negative press from politicians, on the other hand, has been more limited due to fear of potential backlash if seen to be seeking to deny patients this option.

As the turmoil continues to unfold across the Atlantic, here in Europe we were curious as to what the global repercussions of this controversial decision might be from a market access and pricing perspective. We surveyed 11 payers in our network from France, Spain and Italy to get their views on the FDA’s approval and the implications it may have on P&R decisions in their country.

Reflecting the highly charged nature of the arguments on both sides, the responses we received were polarized: “I find the approval terrible and the price outrageous”, commented one payer, with several in our sample raising concerns about high levels of uncertainty given the failure of two studies (ENGAGE and EMERGE) to conclusively demonstrate clinical efficacy.

However other payers registered more excitement and enthusiasm for the drug, with one suggesting it could open up “a better future for many people”. Another registered great interest in introducing the drug, provided it is used for appropriate patients and prescribed with limitations in order to manage the high cost per patient. On this topic, one pointed out that while the price appears high, they believe it can be supported by economic models including Budget Impact Analysis, Cost Effectiveness Analysis and Cost Utility Analysis due to the high indirect costs of the disease in the absence of a comparator (it is however worth noting that ICER’s recently-published analysis only supported a price of between $3000 and $8400 per year for patients with early Alzheimer’s disease in order to be cost-effective).

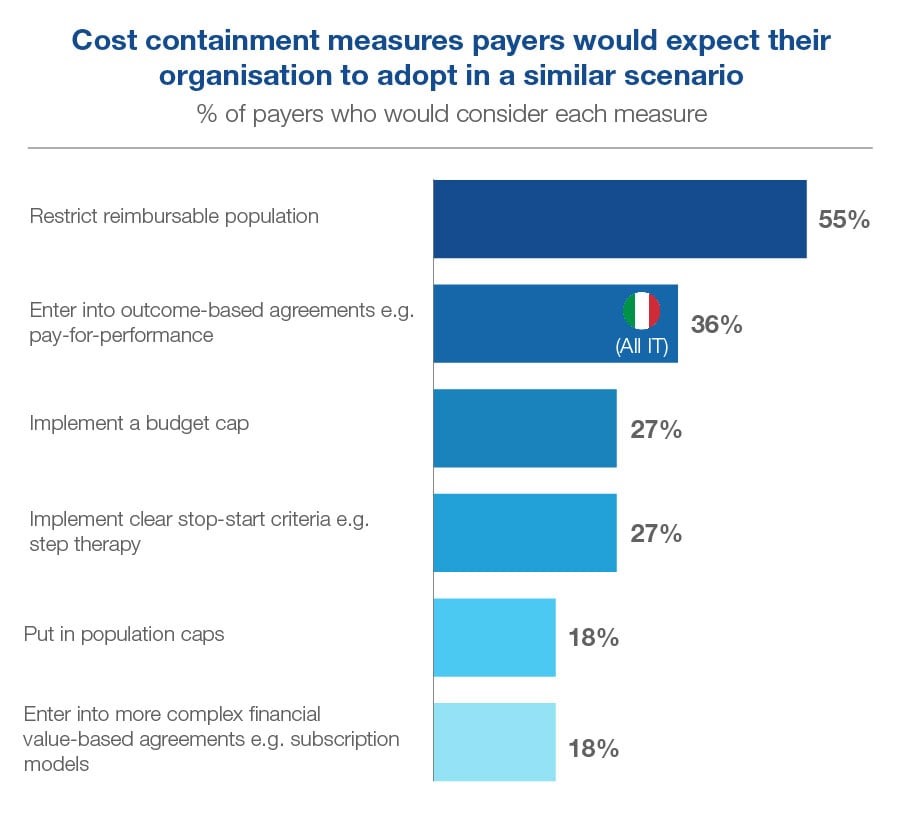

Unsurprisingly, most payers expect to see lower prices and more access restrictions for Aduhelm if and when it is approved in the EU, with 55% of our sample anticipating the reimbursable population will be restricted in order to contain costs.

That said, the payers we spoke to are unclear what these restrictions should entail, and the extent to which they should be clinical and/or financial, given the challenges in establishing which sub-sets of Alzheimer’s disease patients stand to receive the most benefit from the drug. The FDA’s conditional approval of aducanumab gives a broad label covering all Alzheimer’s disease patients, even though its clinical trials included only patients with mild cognitive impairment or mild dementia.

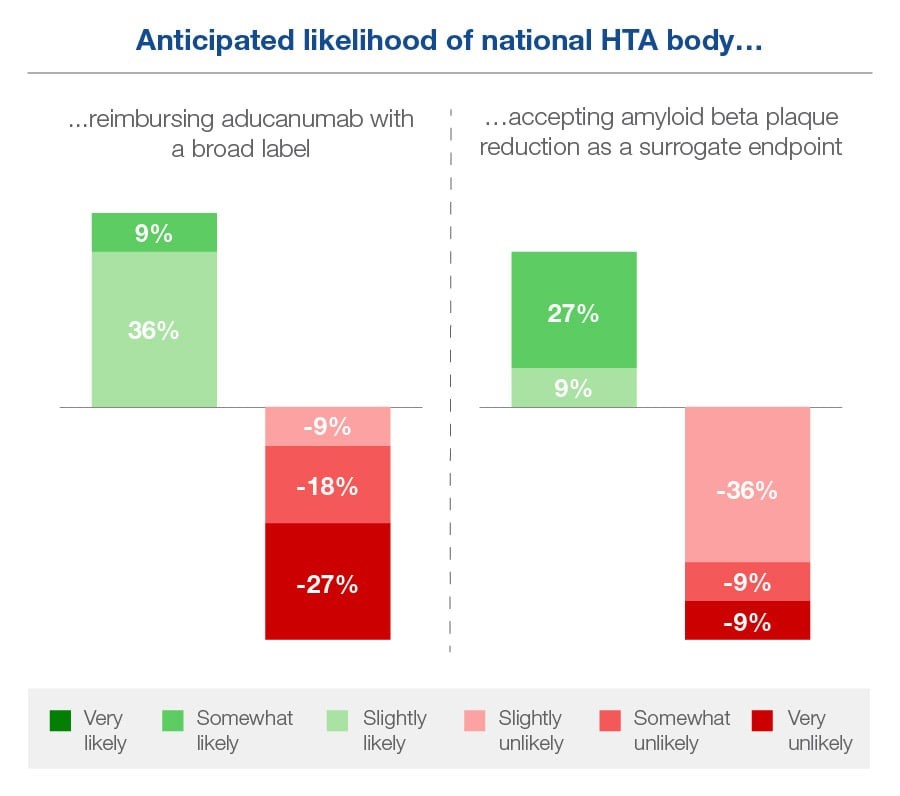

Assuming it is approved by the EMA, only 27% of the payers we surveyed considered it ‘very or somewhat likely’ that the national HTA body in their country would follow the FDA and reimburse aducanumab with a broad label beyond the trial population. 45% considered it ‘very or somewhat unlikely’. Analysis of which sub-populations to target is deemed to be a priority. The FDA has since narrowed Aduhelm’s label to restrict recommended use to patients with milder forms of Alzheimer’s disease in response to widespread criticism.

Payers seem even more on the fence about whether their national HTA body would follow the FDA and accept amyloid beta plaque reduction as a surrogate endpoint. None considered this to be ‘very likely’, though 36% thought it was ‘somewhat or slightly likely’. 55% deemed this unlikely, though few felt confident about it.

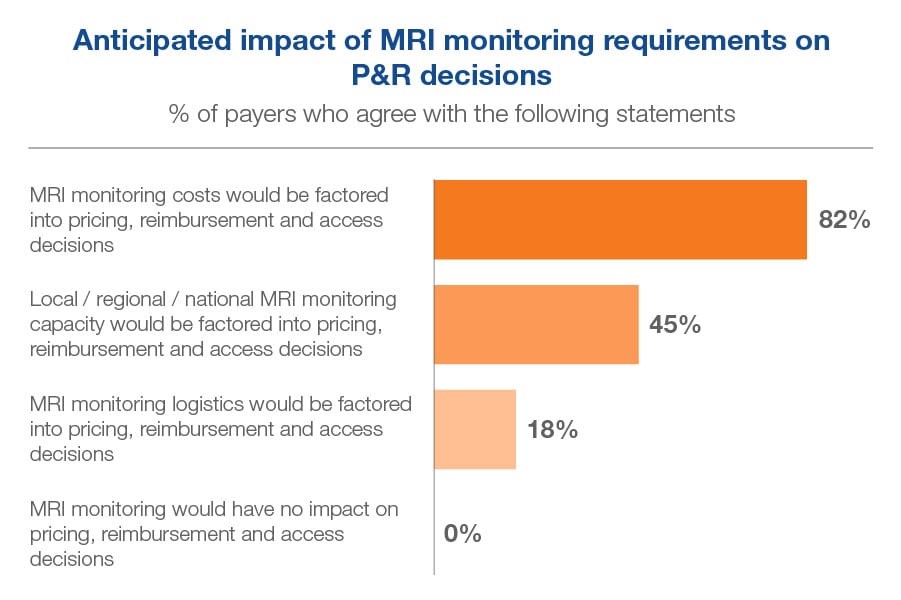

Another not-to-be-overlooked access consideration for aducanumab relates to the practicalities of using it. The drug has a requirement for MRI scans before treatment commencement and then prior to 7th and 12th infusions. With cost, capacity and logistics of MRI monitoring presenting a potential issue – especially if the label granted in the EU opens up its use to as broad a population as in the US, we wanted to understand how European payers might respond to these MRI monitoring requirements in a drug with a similar indication population size.

All payers in our sample recognized MRI monitoring requirements would have some impact on their country’s pricing, reimbursement and access decisions. The vast majority, 82% agreed that the costs of monitoring would be factored into these decisions, but only 45% thought capacity would be factored in, and even fewer, 18%, expected logistics to be factored in. However, only 18% agreed that they would want to enter into a service-based agreement with the manufacturer to overcome MRI monitoring concerns.

When it comes to managing the costs, one payer mentioned we’ve been in a similar situation before, with Gilead’s breakthrough HCV treatment Sovaldi (sofosbuvir) – although there was a huge difference in this case due to the undoubted cost effectiveness of the curative treatment despite the immediate budget impact. We were therefore interested to understand what cost-containment measures the EU payers expected their organizations to adopt in a scenario where a broad label has been granted for a high-cost drug in Alzheimer’s disease.

Beyond the majority expecting that the reimbursable population will be restricted, payers seemed open to considering a range of measures to be adopted to contain the costs. Outcomes-based agreements such as pay-for-performance were widely expected in Italy, while some in Italy and Spain expected a budget cap and a minority across all three countries saw the potential to implement clear stop-start criteria in the form of step therapy. Population caps and more complex agreements such as subscription models were less popular.

Ultimately, even the most enthusiastic European payers who shared their views with us required more data – both a deeper analysis of aducanumab’s mechanism of action and a clearer identification of which patients stand to benefit from it the most – and more time to help them evaluate how best to balance the costs and the benefits. With the EMA still reviewing aducanumab, it is clear that payers here in Europe will be (in many cases rather nervously) watching how things continue to play out in the US, so they can apply the most valuable learnings from their real-world clinical and economic experiences of granting access to the drug.

Sign up to receive Rapport.

Rapport is our monthly newsletter where we share our latest expertise and experience.